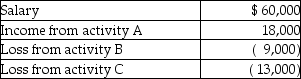

Nancy reports the following income and loss in the current year.  All three activities are passive activities with respect to Nancy. Nancy also has $21,000 of suspended losses attributable to activity C carried over from prior years. During the year, Nancy sells activity C and realizes a $15,000 taxable gain. What is Nancy's AGI as a result of these transactions?

All three activities are passive activities with respect to Nancy. Nancy also has $21,000 of suspended losses attributable to activity C carried over from prior years. During the year, Nancy sells activity C and realizes a $15,000 taxable gain. What is Nancy's AGI as a result of these transactions?

Definitions:

Pattern of Usage

Refers to the habitual ways in which a service or product is utilized over time by consumers or within an organization.

Site Preparation

The process of making a piece of land suitable for construction or other specific purposes, including clearing, grading, and installing foundational infrastructure.

Delivery Costs

Expenses associated with the distribution or transport of goods from the manufacturer or warehouse to the end customer.

Installation Costs

The expenses incurred to put an asset into operation and prepare it for use, including costs of setting up, assembling, and installing.

Q2: Renee is single and has taxable income

Q2: Back when Emily's parents were in school,practically

Q4: If an individual is self-employed, business-related expenses

Q13: A child's status category tends to stay

Q25: Deferred compensation refers to methods of compensating

Q26: According to Bernard Weiner's (1985,1992)attribution theory,one influential

Q28: During puberty,the HPG axis sets in motion

Q49: In ancient Athens,boys became full citizens at

Q63: Gayle, a doctor with significant investments in

Q100: Hugh contributes a painting to a local