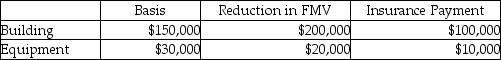

Lena owns a restaurant which was damaged by a tornado. The following assets were partially destroyed:  Lena has AGI of $50,000. What is the amount of Lena's deductible casualty loss?

Lena has AGI of $50,000. What is the amount of Lena's deductible casualty loss?

Definitions:

Coordinated Sales

Coordinated sales involve a strategic approach to selling that typically includes collaboration between different parties or departments to optimize sales efforts and outcomes.

Rule-Of-Reason Analysis

A legal principle used in antitrust law that evaluates the reasonableness of a restrictive business practice based on its circumstances, purpose, and effect on competition, rather than deeming it illegal per se.

Quick-Look Analysis

A preliminary, expedited evaluation of a situation or set of data to gain an initial understanding and guide further in-depth analysis.

California Dental Association

A nonprofit organization representing the dental profession in California, dedicated to advancing the profession through education, advocacy, and member services.

Q15: Which of the following statements regarding Health

Q22: "I was hurt when Jenny didn't come

Q33: A taxpayer incurs a net operating loss

Q51: Clayton contributes land to the American Red

Q51: Those in the rejected-aggressive category tend to

Q53: On September 1, of the current year,

Q63: Juanita knits blankets as a hobby and

Q111: Don's records contain the following information: 1.

Q121: Jason, who lives in New Jersey, owns

Q127: Why can business investigation expenditures be deducted