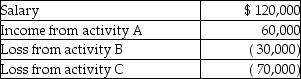

Jana reports the following income and loss:  Activities A, B, and C are all passive activities.

Activities A, B, and C are all passive activities.

Based on this information, Joy has the following suspended losses:

Definitions:

Imperfectly Competitive Industry

An industry in which individual firms have some control over the price of their output.

Substitutes Exist

A situation in which multiple products or services can fulfill the same need or desire, allowing consumers to switch among them based on price, quality, or preference.

Raise Price

An action taken by producers or sellers to increase the cost at which goods or services are sold, often in response to market conditions.

Single Firm

Refers to an individual business entity that operates in a market, typically producing goods or services.

Q6: Losses are generally deductible if incurred in

Q31: The vacation home limitations of Section 280A

Q53: Rachel has significant travel and entertainment expenses

Q76: Charitable contributions made to individuals are deductible

Q87: Sarah purchased a new car at the

Q89: Taxpayers may deduct lobbying expenses incurred to

Q90: A taxpayer guarantees another person's obligation and

Q99: Galvin Corporation has owned all of the

Q113: Tina purchases a personal residence for $278,000,

Q131: Kim currently lives in Buffalo and works