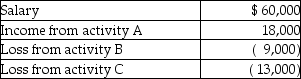

Nancy reports the following income and loss in the current year.  All three activities are passive activities with respect to Nancy. Nancy also has $21,000 of suspended losses attributable to activity C carried over from prior years. During the year, Nancy sells activity C and realizes a $15,000 taxable gain. What is Nancy's AGI as a result of these transactions?

All three activities are passive activities with respect to Nancy. Nancy also has $21,000 of suspended losses attributable to activity C carried over from prior years. During the year, Nancy sells activity C and realizes a $15,000 taxable gain. What is Nancy's AGI as a result of these transactions?

Definitions:

Taxable

Describes income or transactions subject to taxation under federal, state, or local laws.

Traditional IRA

A tax-advantaged retirement account allowing individuals to make pre-tax contributions, with taxes deferred until withdrawals in retirement.

Deductible Contributions

Contributions made to certain types of retirement accounts or health savings accounts that can be subtracted from taxable income.

Fully Taxable

Relates to income or transactions that are subject to tax at the full applicable rate without any exemptions or deductions.

Q3: What would you say are the most

Q11: Wang, a licensed architect employed by Skye

Q27: Kwame is wondering how to get closer

Q31: Dues paid to social or athletic clubs

Q52: In which of the following situations is

Q58: Educational expenses incurred by a bookkeeper for

Q65: In a contributory defined contribution pension plan,

Q67: On Form 1040, deductions for adjusted gross

Q88: Expenditures which do not add to the

Q97: The destruction of a capital asset by