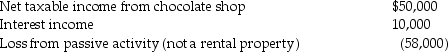

Hersh realized the following income and loss this year:

a. Assume Hersh is an individual taxpayer and the chocolate shop is his sole proprietorship. Determine Hersh's AGI and any carryovers.

a. Assume Hersh is an individual taxpayer and the chocolate shop is his sole proprietorship. Determine Hersh's AGI and any carryovers.

b. Assume the taxpayer is Hersh Inc., a C corporation, owned 100% by the Hersh family. Determine Hersh Inc.'s taxable income and any carryovers.

Definitions:

Attitude Object

An entity that is the focus of an individual's attitude, encompassing anything toward which a person has a positive or negative evaluation or feeling.

Balance Theory

A theory in social psychology suggesting that individuals seek consistency and balance among their beliefs, attitudes, and sentiments in relation to others.

Unit Relation

The connection and interdependence between individual components within a system or structure, determining how they function together as a whole.

Sentiment Relation

Sentiment Relation refers to the connection between emotions and attitudes and how they influence each other in the context of communication or analysis.

Q15: "No additional cost" benefits are excluded from

Q16: Ruby Corporation grants stock options to Iris

Q17: How is the course of physical and

Q25: Armanti received a football championship ring in

Q30: Mae Li is beneficiary of a $70,000

Q46: According to Robert LeVine,in raising children,families implicitly

Q50: Shanti is one of the first girls

Q71: Daniel purchased qualified small business corporation stock

Q101: According to the IRS, a person's tax

Q106: Anita has decided to sell her stock