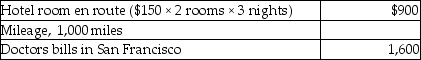

In 2014 Sela traveled from her home in Flagstaff to San Francisco to seek medical care. Because she was unable to travel alone, her mother accompanied her. Total expenses included:  The total medical expenses deductible before the 10% limitation are

The total medical expenses deductible before the 10% limitation are

Definitions:

Pollutants

Substances introduced into the environment that cause harm or discomfort to the ecosystem or living organisms.

Corrective Taxes

Taxes implemented to correct the market outcomes that are not efficient by internalizing external costs, often used in environmental policy to address pollution.

Regulations

Standards and rules formulated by governmental or nongovernmental organizations to govern conduct within certain spheres of activity.

Pollution Permits

Marketable permits allowing holders to emit a certain amount of pollution, used as a regulatory tool to control environmental impacts.

Q3: Sacha, a dentist, has significant investment assets.

Q3: Everest Inc. is a corporation in the

Q27: Fees paid to prepare a taxpayer's Schedule

Q40: Loan proceeds are taxable in the year

Q56: Lindsay Corporation made the following payments to

Q61: Ross works for Houston Corporation, which has

Q88: For federal income tax purposes, income is

Q89: A taxpayer is allowed to deduct interest

Q98: Allison buys equipment and pays cash of

Q127: If the stock received as a nontaxable