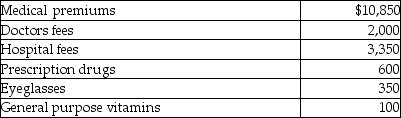

Mitzi's medical expenses include the following:  Mitzi's AGI for the year is $33,000. She is single and age 49. None of the medical costs are reimbursed by insurance. After considering the AGI floor, Mitzi's medical expense deduction is

Mitzi's AGI for the year is $33,000. She is single and age 49. None of the medical costs are reimbursed by insurance. After considering the AGI floor, Mitzi's medical expense deduction is

Definitions:

Non-Military

Pertaining to activities, operations, or organizations not affiliated with armed forces or defense.

Medical Services

A wide range of services provided by healthcare professionals aimed at diagnosing, treating, and preventing diseases and maintaining patient health.

TRICARE for Life

A healthcare program providing expanded health coverage for U.S. military retirees and their eligible beneficiaries.

Q4: During the current year, Jane spends approximately

Q11: Josh purchases a personal residence for $278,000

Q15: Which of the following statements regarding Health

Q28: Gina owns 100 shares of XYZ common

Q31: John, who is President and CEO of

Q31: The effects of having both parents employed

Q39: Major change(s)in the lives of Canadian adolescents

Q80: Douglas and Julie are a married couple

Q99: A business provides $45,000 of group-term life

Q123: A taxpayer goes out of town to