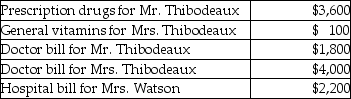

Mr. and Mrs. Thibodeaux, who are filing a joint return, have adjusted gross income of $75,000. During the tax year, they paid the following medical expenses for themselves and for Mrs. Thibodeaux's mother, Mrs. Watson (age 63) . Mrs. Watson provided over one-half of her own support.  Mr. and Mrs. Thibodeaux received no reimbursement for the above expenditures. What is the amount of their deductible itemized medical expenses?

Mr. and Mrs. Thibodeaux received no reimbursement for the above expenditures. What is the amount of their deductible itemized medical expenses?

Definitions:

Markov Model

A statistical model used to predict the probability of different states or events in the future, based on the current state and historical transitions.

Movement Behaviours

The actions and activities associated with physical movement, including all forms of motion and activity by individuals or objects.

Personnel Supply

Refers to the available pool of workers from which an organization can recruit or select to meet its employment needs.

Vacancy Model

A theoretical framework used to explain the dynamics of job vacancies within an organization, often focusing on the causes and effects of these vacancies.

Q5: Expenditures for long-term care insurance premiums qualify

Q21: Jason sells stock with an adjusted basis

Q24: Gross income may be realized when a

Q30: Mae Li is beneficiary of a $70,000

Q46: For charitable contribution purposes, capital gain property

Q47: Deductions for AGI may be located<br>A)on the

Q56: Commuting to and from a job location

Q59: John, an employee of a manufacturing company,

Q82: Premiums paid by an employer for employee

Q96: Hobby expenses are deductible as for AGI