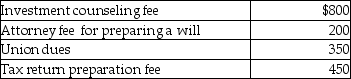

Daniel had adjusted gross income of $60,000, which consisted of $55,000 in wages and $5,000 in dividend income from taxable domestic corporations. His expenses include:  What is the net amount deductible by Daniel for the above items?

What is the net amount deductible by Daniel for the above items?

Definitions:

Operant Conditioning

A strategy of learning wherein the impact of a response is adjusted through the provision of incentives or the application of penalties.

Evolutionary Perspective

An approach in psychology that seeks to explain mental and psychological traits—such as memory, perception, or language—as adaptations, i.e., as the functional products of natural selection.

Species-Specific

Characteristics or behaviors that are unique to a particular species.

Adaptive Challenges

Situations or problems that require individuals or organizations to adapt and change their strategies, behaviors, or attitudes.

Q14: If property that qualifies as a taxpayer's

Q30: Jamie sells investment real estate for $80,000,

Q39: Distributions from corporations to the shareholders in

Q50: Patrick,a 10th grader,does not believe there are

Q54: The psychometric approach to cognition focuses on<br>A)universal

Q68: Fatima's employer funds childcare for all employees'

Q71: Leigh pays the following legal and accounting

Q72: Capitalization of interest is required if debt

Q86: Income from illegal activities is taxable.

Q95: In 2014 Sela traveled from her home