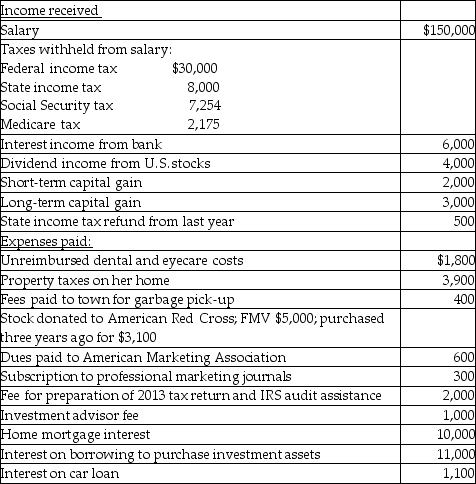

Hope is a marketing manager at a local company. Information about her 2014 income and expenses is as follows:

Compute Hope's taxable income for the year in good form. Show all supporting computations. Hope is single, and she elects to itemize her deductions each year. Assume she does not make any elections regarding the investment interest expense. Also assume that her tax profile was similar in the preceding year.

Compute Hope's taxable income for the year in good form. Show all supporting computations. Hope is single, and she elects to itemize her deductions each year. Assume she does not make any elections regarding the investment interest expense. Also assume that her tax profile was similar in the preceding year.

Definitions:

Eye Tracking

A technique that measures where and how long a person looks at certain points on a screen or in the physical environment, often used in marketing research.

fMRI

Functional Magnetic Resonance Imaging, a method of brain imaging that monitors neural activity through observing blood flow variations.

EEG

Electroencephalography, a non-invasive method used to record electrical activity of the brain through sensors placed on the scalp, often used in neuroscience research and medical diagnostics.

Qualitative Research

Research methods that collect non-numerical data to understand concepts, thoughts, or experiences.

Q13: Discuss briefly the options available for avoiding

Q25: Taxpayers may not deduct interest expense on

Q38: How is a claim for refund of

Q40: On December 1, Robert, a cash method

Q70: Accrual-basis taxpayers are allowed to deduct expenses

Q71: Daniel purchased qualified small business corporation stock

Q90: Victor, a calendar year taxpayer, owns 100

Q104: Rebecca is the beneficiary of a $500,000

Q121: Jonathon, age 50 and in good health,

Q125: Terra Corp. purchased a new enterprise software