Multiple Choice

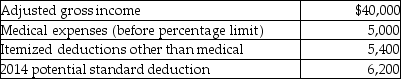

A review of the 2014 tax file of Gregory, a single taxpayer who is age 40, provides the following information regarding Gregory's 2014 tax status:  In 2015, Gregory receives a reimbursement for last year's medical expenses of $1,200. As a result, Gregory must

In 2015, Gregory receives a reimbursement for last year's medical expenses of $1,200. As a result, Gregory must

Analyze the relationship between organizational culture strength, alignment with the external environment, and business ethics.

Understand the process and purpose of conducting a bicultural audit in mergers and acquisitions.

Identify the strategies employed to integrate or differentiate cultures during organizational mergers and acquisitions.

Understand various roles of supervision (teacher, consultant, mentor, coach) and their functions.

Definitions:

Related Questions

Q24: In September of 2014, Michelle sold shares

Q28: With some exceptions, amounts withdrawn from a

Q32: Canadian teens spend twice as much time

Q36: All of the following may deduct education

Q74: Explain the rules for determining whether a

Q88: For federal income tax purposes, income is

Q94: In October 2014, Jonathon Remodeling Co., an

Q97: The destruction of a capital asset by

Q106: Benefits covered by Section 132 which may

Q116: Which of the following statements regarding Coverdell