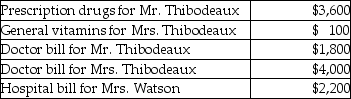

Mr. and Mrs. Thibodeaux, who are filing a joint return, have adjusted gross income of $75,000. During the tax year, they paid the following medical expenses for themselves and for Mrs. Thibodeaux's mother, Mrs. Watson (age 63) . Mrs. Watson provided over one-half of her own support.  Mr. and Mrs. Thibodeaux received no reimbursement for the above expenditures. What is the amount of their deductible itemized medical expenses?

Mr. and Mrs. Thibodeaux received no reimbursement for the above expenditures. What is the amount of their deductible itemized medical expenses?

Definitions:

Nonvoluntary Euthanasia

The practice of ending a person's life without their explicit consent, often because the individual is unable to make such a decision.

Advance Directive

A legal document that outlines a person's wishes regarding their healthcare treatment in scenarios where they are unable to make decisions for themselves.

Singer

Refers to Peter Singer, a bioethicist known for his work on animal rights and ethics in human decision-making.

Autonomy

The capacity to make one's own decisions and govern oneself, often highlighted as a foundational ethical principle.

Q1: Vera has a key supplier for her

Q2: Renee is single and has taxable income

Q15: Joy reports the following income and loss:

Q20: A closely held C Corporation's passive losses

Q40: Compared to younger children,adolescents are better at<br>A)thinking

Q49: If an NOL is incurred, when would

Q49: In ancient Athens,boys became full citizens at

Q61: Which of the following items will result

Q67: Hannah is a 52-year-old an unmarried taxpayer

Q70: What are some factors which indicate that