Multiple Choice

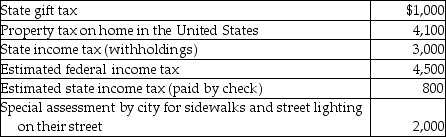

During the year Jason and Kristi, cash basis taxpayers, paid the following taxes:  What amount can Kristi and Jason claim as an itemized deduction for taxes on their federal income tax return in the current year?

What amount can Kristi and Jason claim as an itemized deduction for taxes on their federal income tax return in the current year?

Definitions:

Related Questions

Q11: Charlie owns activity B which was considered

Q17: While points paid to purchase a residence

Q37: Leonard owns a hotel which was damaged

Q43: One of the requirements which must be

Q47: Gambling losses are miscellaneous itemized deductions subject

Q47: Dustin purchased 50 shares of Short Corporation

Q53: A check received after banking hours is

Q54: A nursing home maintains a cafeteria that

Q88: Expenditures which do not add to the

Q88: Distinguish between the accrual-method taxpayer and the