Phoebe's AGI for the current year is $120,000. Included in this AGI is $100,000 salary and $20,000 of interest income. In earning the investment income, Phoebe paid investment interest expense of $30,000. She also incurred the following expenditures subject to the 2% of AGI limitation:

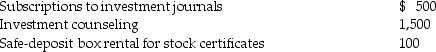

Investment expenses:

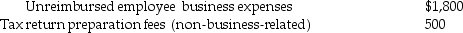

Noninvestment expenses:

Noninvestment expenses:

What is Phoebe's investment interest expense deduction for the year?

What is Phoebe's investment interest expense deduction for the year?

Definitions:

Disjunction

An operation in logic that returns true when a minimum of one input is true.

Tautologies

Statements that are true under any possible valuation of their components in logic.

Biconditional

A logical statement that is true only if both the conditions it connects are either true or false.

Tautology

A proposition that is inherently true due to its logical structure or necessity, frequently restating the same concept using varied terminology.

Q14: "My enemy's enemy is my friend" is

Q28: "Working condition fringe benefits," such as memberships

Q41: Benito,13,lives in the capital city of a

Q45: The Cable TV Company, an accrual basis

Q54: Sarah had a $30,000 loss on Section

Q57: As a result of a divorce, Michael

Q69: For a taxpayer who is not insolvent

Q71: Antonio owns land held for investment with

Q99: A loss incurred on the sale or

Q108: For a bad debt to be deductible,