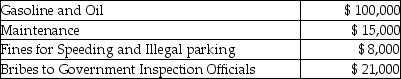

Jimmy owns a trucking business. During the current year he incurred the following:  What is the total amount of deductible expenses?

What is the total amount of deductible expenses?

Definitions:

Agent Liability

The legal responsibility of an agent to act in the best interest of their principal, facing consequences for failure to comply.

Apparent Authority

The power that a third party perceives an agent to have, based on the principal's representations, leading the third party to reasonably believe that the agent is authorized.

Undisclosed Principal

A person whose existence is unknown to the third party in a contract made by an agent on their behalf.

Apparent Authority

The power that a third party perceives an agent has over the principal, based on the principal's behavior.

Q4: Meals may be excluded from an employee's

Q8: Losses incurred in the sale or exchange

Q35: On the first day of class,Professor Parameswaran

Q41: Taxpayers may elect to include net capital

Q45: Chad and Jaqueline are married and have

Q79: Tobey receives 1,000 shares of YouDog! stock

Q88: Wilson Corporation granted an incentive stock option

Q103: Linda was injured in an automobile accident

Q108: For a bad debt to be deductible,

Q129: In 2014 the standard deduction for a