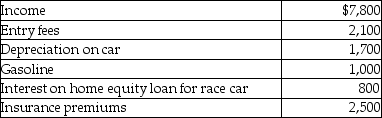

Kyle drives a race car in his spare time and on weekends. His records regarding this activity reflect the following information for the year.  What is the allowable deduction (before any AGI limitation) for depreciation assuming that this activity is not engaged in for profit and Kyle can itemize his deductions?

What is the allowable deduction (before any AGI limitation) for depreciation assuming that this activity is not engaged in for profit and Kyle can itemize his deductions?

Definitions:

Abbot Suger

A French abbot of the 12th century known for his role in developing Gothic architecture, especially through his work on the Basilica of St. Denis.

Giorgio Vasari

An Italian painter, architect, and writer known for his biographies of Renaissance artists in "The Lives of the Most Excellent Painters, Sculptors, and Architects."

Louis IX

Louis IX, known as Saint Louis, was King of France from 1226 until his death in 1270 and is the only French king canonized in the Catholic Church.

Contrapposto

The disposition of the human figure in which one part is turned in opposition to another part (usually hips and legs one way, shoulders and chest another), creating a counterpositioning of the body about its central axis. Sometimes called “weight shift” because the weight of the body tends to be thrown to one foot, creating tension on one side and relaxation on the other.

Q3: Which of the following bonds do not

Q4: If an individual is self-employed, business-related expenses

Q5: Melanie, a single taxpayer, has AGI of

Q24: Gross income may be realized when a

Q28: For purposes of the application of the

Q55: Gabby owns and operates a part-time art

Q72: Capitalization of interest is required if debt

Q84: Johanna is single and self-employed as a

Q90: A charitable contribution in excess of the

Q122: At the election of the taxpayer, a