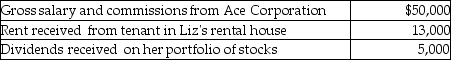

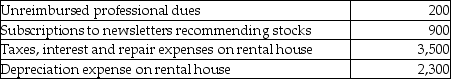

Liz, who is single, lives in a single family home and owns a second single family home that she rented for the entire year at a fair rental rate. Liz had the following items of income and expense during the current year. Income: Expenses:

Expenses: What is her adjusted gross income for the year?

What is her adjusted gross income for the year?

Definitions:

Written Memos

Brief written messages, typically used within an organization to communicate information, directives, or updates.

Important Instructions

Critical or necessary directions or orders that need to be followed.

Immediate Action

A prompt response or decision taken swiftly to address a situation or problem.

Workplace Professionalism

The conduct, behavior, and attitude of an individual in a work environment, highlighting competence and ethical standards.

Q7: Taxpayers are allowed to recognize net passive

Q25: Deferred compensation refers to methods of compensating

Q32: Losses incurred on wash sales of stock

Q32: Monte inherited 1,000 shares of Corporation Zero

Q53: On September 1, of the current year,

Q53: During 2014, Marcia, who is single and

Q60: Derrick was in an automobile accident while

Q89: If a taxpayer's method of accounting does

Q103: Bob owns 100 shares of ACT Corporation

Q117: The gain or loss on an asset