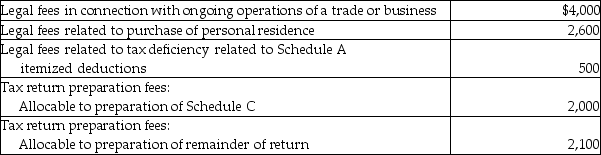

Maria pays the following legal and accounting fees during the year:  What is the total amount of her for AGI deduction for these fees?

What is the total amount of her for AGI deduction for these fees?

Definitions:

Personal Property

Items owned by an individual that are moveable and not permanently attached to or part of real estate.

Hudson v. Palmer

A 1984 U.S. Supreme Court case ruling that prison officials have the authority to search cells and confiscate any materials found, without violating the Fourth Amendment.

Ethical Standards

The principles and codes of conduct that govern the behavior of individuals and organizations in various professions and situations.

Modern Era

A period in history marked by significant changes in society, technology, and culture, broadly considered to start from the late 19th century to the present.

Q16: Accelerated death benefits received by a terminally

Q29: Jack exchanged land with an adjusted basis

Q34: Alex is a self-employed dentist who operates

Q45: When Brandon was 14,his parents separated and

Q52: In which of the following situations is

Q65: The initial adjusted basis of property depends

Q68: No deduction is allowed for a partially

Q73: Funds borrowed and used to pay for

Q83: Which of the following statements is false?<br>A)Under

Q114: On August 1 of this year, Sharon,