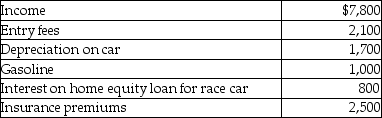

Kyle drives a race car in his spare time and on weekends. His records regarding this activity reflect the following information for the year.  What is the allowable deduction (before any AGI limitation) for depreciation assuming that this activity is not engaged in for profit and Kyle can itemize his deductions?

What is the allowable deduction (before any AGI limitation) for depreciation assuming that this activity is not engaged in for profit and Kyle can itemize his deductions?

Definitions:

Software Application Programs

Computer programs designed to perform specific tasks for users.

Power Distance

This term refers to the degree to which individuals in a society accept and expect power to be distributed unequally.

National Culture

The shared values, norms, behaviors, and artifacts of a nation's inhabitants that distinguish it from other nations.

Geert Hofstede

A Dutch social psychologist known for his research on cross-cultural groups and organizations, notably for pioneering the study of cultural dimensions affecting work behavior.

Q5: A $10,000 gain earned on stock held

Q9: Examples of income which are constructively received

Q19: Takesha paid $13,000 of investment interest expense

Q20: Tia is a 52-year-old an unmarried taxpayer

Q38: Mattie has group term life insurance coverage

Q42: Rocky owns The Palms Apartments. During the

Q52: During the early 20th century in Canada,adolescent

Q89: Section 1221 of the Code includes a

Q114: In December of this year, Jake and

Q125: A deduction will be allowed for an