During the current year, Lucy, who has a sole proprietorship, pays legal and accounting fees for the following:

Services rendered in resolving a federal tax deficiency

Services rendered in resolving a federal tax deficiency

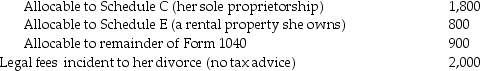

Tax return preparation fees:

Tax return preparation fees:

What amount is deductible for AGI?

What amount is deductible for AGI?

Definitions:

Patient Discharge Teaching

Education and information given to patients and their caregivers to understand their care needs, medications, follow-up appointments, and any home care required after leaving the healthcare facility.

Patient Bed Bath

A method of bathing a bedridden or immobile patient with limited movement, ensuring hygiene while minimizing patient strain.

SBAR

A structured method for communication that stands for Situation, Background, Assessment, and Recommendation; commonly used in healthcare settings.

Severe Pain

An intense level of discomfort signaling acute or chronic medical conditions, requiring prompt management or treatment.

Q19: Mark and his brother, Rick, each own

Q47: If a taxpayer suffers a loss attributable

Q52: Jones, Inc., a calendar-year taxpayer, is in

Q52: In which of the following situations is

Q71: Daniel purchased qualified small business corporation stock

Q73: Hope sustained a $3,600 casualty loss due

Q93: Edward, a single taxpayer, has AGI of

Q127: Why can business investigation expenditures be deducted

Q128: Rob is a taxpayer in the top

Q132: Edward incurs the following moving expenses: <img