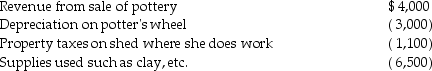

Margaret, a single taxpayer, operates a small pottery activity in her spare time. During the current year, she reported the following income and expenses from this activity which is classified as a hobby:

In addition, she had salary of $75,000 and itemized deductions, not including those listed above, of $2,200.

In addition, she had salary of $75,000 and itemized deductions, not including those listed above, of $2,200.

What is the amount of her taxable income?

Definitions:

Lithotomy

A medical position in which the patient lies on their back with legs elevated and spread apart, commonly used for gynecological and other medical procedures.

Vaginal Discharge

Fluid or mucus that is expelled from the vagina, which can be a normal physiological response or an indication of infection or other health conditions.

Examination

The process of investigating or assessing a subject, condition, or phenomenon, often for diagnostic purposes.

Ecchymosis

Discoloration of the skin or bruise caused by leakage of blood into subcutaneous tissues as a result of trauma to underlying tissues.

Q1: Qualified residence interest consists of both acquisition

Q2: Renee is single and has taxable income

Q4: Lily had the following income and losses

Q18: Ted pays $2,100 interest on his automobile

Q27: Discuss what circumstances must be met for

Q39: Distributions from corporations to the shareholders in

Q54: Matt is a sales representative for a

Q56: An electrician completes a rewiring job and

Q104: Samuel, a calendar year taxpayer, owns 100

Q128: Margaret died on September 16, 2014, when