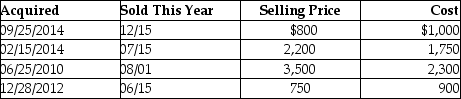

This year, Lauren sold several shares of stock held for investment. The following is a summary of her capital transactions for 2014:  What are the amounts of Lauren's capital gains (losses) for this year?

What are the amounts of Lauren's capital gains (losses) for this year?

Definitions:

Organizational Operating Surplus

The excess of revenues over operating expenses within an organization, indicating financial health and efficiency.

Accounting

the systematic process of recording, analyzing, and reporting financial transactions for a business or individual.

Financial Management

The efficient and effective management of money in such a manner as to accomplish the objectives of the organization.

Fixed Assets

Long-term tangible assets, such as buildings, machinery, and equipment, that a company uses in its operations and is not expected to consume or sell within a year.

Q5: Expenditures for long-term care insurance premiums qualify

Q15: Pamela was an officer in Green Restaurant

Q17: Gains realized from property transactions are included

Q25: Taxpayers may not deduct interest expense on

Q26: In 2014, Sean, who is single and

Q36: The Flow-Through Model used for S corporations

Q46: For charitable contribution purposes, capital gain property

Q89: If a taxpayer's method of accounting does

Q92: A charitable contribution deduction is allowed for

Q100: Insurance proceeds received because of the destruction