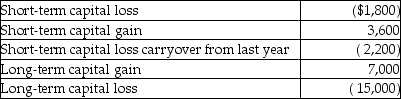

During the current year, Nancy had the following transactions:  What is the amount of her capital loss deduction for the current year, and what is the amount and character of her capital loss carryover?

What is the amount of her capital loss deduction for the current year, and what is the amount and character of her capital loss carryover?

Definitions:

SUTA Rate

The rate imposed on employers by a state to fund unemployment benefits, varying by state and the employer's claim history.

Interstate Commerce

Refers to any business or trade activity that crosses state lines, regulated by the federal government in the United States.

Federal Income Tax

A fiscal duty assessed by the federal authority on the annual revenues of people, firms, trusts, and assorted legal entities.

FICA Rate

The total percentage of Social Security and Medicare taxes that must be paid by both employees and employers under the Federal Insurance Contributions Act.

Q21: All of the following items are included

Q38: Eva and Lisa each retired this year

Q40: When business property involved in a casualty

Q55: Sari is single and has taxable income

Q63: Grace has AGI of $60,000 in 2013

Q79: A taxpayer may avoid tax on income

Q82: For purposes of the dependency exemption, a

Q83: Healthwise Ambulance requires its employees to be

Q93: On July 25, 2013, Karen gives stock

Q97: The destruction of a capital asset by