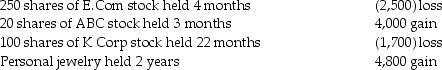

Trista, a taxpayer in the 33% marginal tax bracket sold the following capital assets this year:

What is the amount of and nature of (LT or ST)capital gain or loss? Be specific as to the rates at which gains, if any, are taxed.

What is the amount of and nature of (LT or ST)capital gain or loss? Be specific as to the rates at which gains, if any, are taxed.

Definitions:

Marketers

Professionals who are involved in the promotion and selling of products or services, including market research, advertising, sales, and distribution, aiming to meet consumer needs and achieve business objectives.

Everyday Low Pricing Strategy

is a pricing model where companies consistently offer products at low prices rather than relying on sales or discounts, aiming to attract price-conscious consumers.

Big Box Stores

Large retail establishments, typically part of a chain, that offer a wide variety of goods under one roof in sizable, warehouse-like spaces.

Demand Curve

A graphical representation showing the relationship between the price of a good or service and the quantity demanded by consumers.

Q14: If property that qualifies as a taxpayer's

Q18: The Deferred Model offers two levels of

Q25: Annisa, who is 28 and single, has

Q45: During the current year, the United States

Q56: A liquidating distribution is treated as a

Q58: Jeff, who has been employed by the

Q58: If a partner contributes inventory to the

Q58: Amber supports four individuals: Erin, her stepdaughter,

Q96: Reva is a single taxpayer with a

Q106: Jill is considering making a donation to