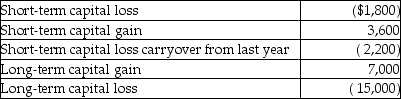

During the current year, Nancy had the following transactions:  What is the amount of her capital loss deduction for the current year, and what is the amount and character of her capital loss carryover?

What is the amount of her capital loss deduction for the current year, and what is the amount and character of her capital loss carryover?

Definitions:

Capital Lease

A lease classified as a financial transaction where the lessee gains substantial control over an asset, treated like an asset purchase.

Bond Indenture

A legal document specifying the terms and conditions under which a bond is issued, including the interest rate, maturity date, and other covenants.

Stated Interest Rate

The annual interest rate declared on a financial instrument, such as a loan or bond, not taking into account compounding or fees.

Market Interest Rate

The prevailing rate of interest available in the market, influencing the rates charged on loans and paid on deposits.

Q23: Jacob, who is single, paid educational expenses

Q23: Fiona is about to graduate college with

Q39: Pat, an insurance executive, contributed $1,000,000 to

Q53: The difference between the BTRORs of fully-taxable

Q54: Antonio is single and has taxable income

Q56: Lindsay Corporation made the following payments to

Q60: An individual buys 200 shares of General

Q74: Judy is considering receiving either $20,000 of

Q104: While using a metal detector at the

Q119: Chen had the following capital asset transactions