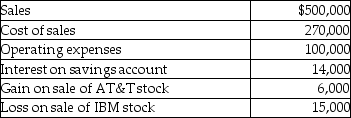

In the current year, ABC Corporation had the following items of income, expense, gains, and losses:  What is taxable income for the year?

What is taxable income for the year?

Definitions:

REM Sleep

A phase of sleep characterized by rapid eye movement, vivid dreaming, and increased brain activity.

REM Sleep

Rapid Eye Movement sleep, a stage of sleep characterized by rapid eye movements, where the most vivid dreams occur.

Information-Processing

Information-Processing refers to the methods by which humans and computers take in, analyze, store, and retrieve information.

Infants

Young children typically aged from birth to one year, characterized by rapid growth and development in physical, cognitive, and emotional aspects.

Q1: Miranda is not a key employee of

Q29: On July 1 of the current year,

Q36: Corporate taxpayers may offset capital losses only

Q47: Internal Revenue Code Section 61 provides an

Q50: The general form of the annualized after-tax

Q51: Kendrick, who has a 35% marginal tax

Q58: Trista, a taxpayer in the 33% marginal

Q79: Diane, a successful accountant with an annual

Q87: Sarah purchased a new car at the

Q107: In 2014, Sam is single and rents