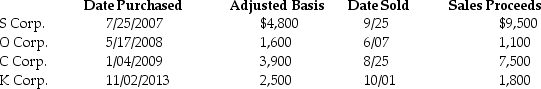

Mike sold the following shares of stock in 2014:

What are the tax consequences of these transactions, assuming his marginal tax rate is (a)33% and (b)39.6%? Ignore the medicare tax on net investment income.

What are the tax consequences of these transactions, assuming his marginal tax rate is (a)33% and (b)39.6%? Ignore the medicare tax on net investment income.

Definitions:

Foreign Antibiotics

Antibacterial substances not native or familiar to a certain environment or organism, often referring to antibiotics from an external source or country.

Transplatin

A platinum-based compound similar to cisplatin but differs in the arrangement of its molecular structure, impacting its effectiveness and use in chemotherapy.

DNA Replication

The biological process of producing two identical replicas of DNA from one original DNA molecule, essential for cell division.

Guanines

One of the four main nucleobases found in the nucleic acids DNA and RNA, pairing with cytosine.

Q15: Amanda has two dependent children, ages 10

Q21: Jason sells stock with an adjusted basis

Q29: Brandon, a single taxpayer, had a loss

Q32: Explain under what circumstances meals and lodging

Q55: Emma is the sole shareholder in Pacific

Q64: Keith, age 17, is a dependent of

Q77: Rita, who has marginal tax rate of

Q80: Mara owns an activity with suspended passive

Q80: Jamal, age 52, is a human resources

Q90: Victor, a calendar year taxpayer, owns 100