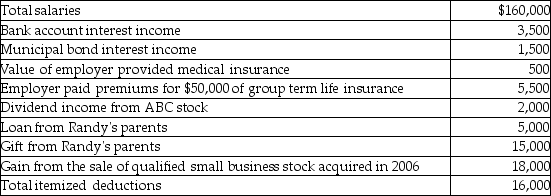

Randy and Sharon are married and have two dependent children. They also fully support Sharon's mother who lives with them and has no income. Their 2014 tax and other related information is as follows:

Compute Randy and Sharon's taxable income. (Show all calculations in good form.)

Compute Randy and Sharon's taxable income. (Show all calculations in good form.)

Definitions:

Class Of Origin

The social class into which an individual is born, influencing their opportunities, outlook, and life experiences, often with implications for social mobility and inequality.

United States

A country located in North America, consisting of 50 states and is known for its significant influence on global economics, politics, and culture.

Functionalist Perspective

A sociological approach that emphasizes the way that the parts of a society are structured to maintain its stability and functionality.

Social Inequality

The presence of imbalanced chances and benefits for varying social ranks or statuses amidst a community or society.

Q3: Which of the following bonds do not

Q12: Candice owns a mutual fund that reinvests

Q19: Amounts collected under accident and health insurance

Q20: John contributes land having $110,000 FMV and

Q33: Cooper can invest $10,000 after-tax dollars in

Q50: Section 1221 specifically states that inventory or

Q52: Stephanie owns a 25% interest in a

Q68: Given that D<sub>n</sub> is the amount of

Q100: Insurance proceeds received because of the destruction

Q110: Five different capital gain tax rates could