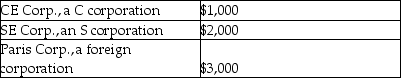

Natasha is a single taxpayer with a 28% marginal tax rate. She received distributions of earnings this year as follows:  How much of the $6,000 distribution will be taxed at the 15% tax rate?

How much of the $6,000 distribution will be taxed at the 15% tax rate?

Definitions:

Comorbid Subsets

Groups of disorders that frequently occur together, offering a more nuanced understanding of complex psychiatric or medical diagnoses.

Major Depressive Episode

A period of at least two weeks characterized by a significant depressed mood or loss of interest in activities, along with other symptoms of depression.

Anxious Distress

A specifier used in diagnostic criteria to indicate the presence of anxiety symptoms alongside another condition.

Persistent Depressive Disorder

A chronic form of depression where a person experiences a depressed mood for most of the day, for more days than not, for at least two years.

Q17: Olivia, a single taxpayer, has AGI of

Q24: In September of 2014, Michelle sold shares

Q40: Individuals Terry and Jim form TJ Corporation.

Q55: Which of the following statements regarding the

Q74: Explain the rules for determining whether a

Q75: Andrea died with an unused capital loss

Q104: Rebecca is the beneficiary of a $500,000

Q117: Generally, itemized deductions are personal expenses specifically

Q119: On July 1, Alexandra contributes business equipment

Q123: Atiqa receives a nonliquidating distribution of land