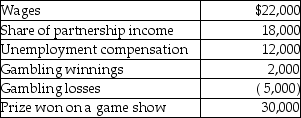

Lori had the following income and losses during the current year:  What is Lori's adjusted gross income (not taxable income) ?

What is Lori's adjusted gross income (not taxable income) ?

Definitions:

General Partner

A type of owner in a partnership who has unlimited liability and is actively involved in the management of the business.

Entrepreneur

An individual who organizes and operates a business or businesses, taking on greater than normal financial risks in order to do so.

Entrepreneurs

Individuals who create, launch, and manage new businesses, often taking on considerable risk in the expectation of profit.

Bankruptcy

A legal process involving a person or business that is unable to repay outstanding debts, resulting in the distribution of assets to creditors.

Q1: Charlene can invest $4,000 of after-tax dollars

Q27: Fees paid to prepare a taxpayer's Schedule

Q37: Nelda suffered a serious stroke and was

Q51: Rachel invests $5,000 in a money market

Q53: Rachel has significant travel and entertainment expenses

Q85: Raoul sells household items on an Internet

Q98: An S corporation distributes land to its

Q104: Samuel, a calendar year taxpayer, owns 100

Q111: Rena and Ronald, a married couple, each

Q123: The child credit is for taxpayers with