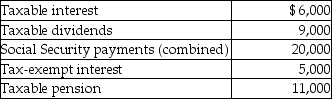

Mr. & Mrs. Bronson are both over 65 years of age and are filing a joint return. Their income this year consisted of the following:  They did not have any adjustments to income. What amount of Mr. & Mrs. Bronson's social security benefits is taxable this year?

They did not have any adjustments to income. What amount of Mr. & Mrs. Bronson's social security benefits is taxable this year?

Definitions:

Flexible Manufacturing

A system that allows for easy adaptation to changes in product design and demand by using versatile equipment and computer systems.

Remote-Controlled Carts

Wheeled conveyances operated from a distance using electronic remote control, often utilized for carrying goods or performing specific tasks.

Offshore Assembly Plants

Factories located in another country than where the finished product is sold, used by companies to reduce production costs.

Q9: DeMarcus and Brianna are married and live

Q19: When property is contributed to a partnership,

Q32: A calendar-year corporation has a $15,000 current

Q41: Donald sells stock with an adjusted basis

Q44: Niral is single and provides you with

Q52: Thomas and Sally were divorced last year.

Q63: When evaluating current salary versus deferred compensation,

Q63: Grace has AGI of $60,000 in 2013

Q68: Chen contributes a building worth $160,000 (adjusted

Q83: Which of the following statements is false?<br>A)Under