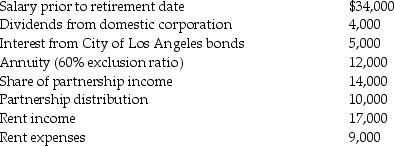

Jeannie, a single taxpayer, retired during the year, to take over the management of some rental property. She had the following items of income and expense:

What is Jeannie's adjusted gross income for the year?

What is Jeannie's adjusted gross income for the year?

Definitions:

Company Growth

The increase in the size, output, or market share of a corporation over time.

Planning Improves

The process of making plans helps to enhance effectiveness and efficiency by providing direction and reducing uncertainty.

Action Orientation

A personality trait or behavior characterized by proactive decision-making and initiative-taking in facing tasks or challenges.

Coordination

The act of organizing and aligning different elements or activities of an organization to ensure they work together effectively towards a common goal.

Q5: Liza's employer purchased a disability income policy

Q24: A corporation has the following capital gains

Q42: Louisiana Land Corporation reported the following results

Q43: Kate is single and a homeowner. In

Q81: A child credit is a partially refundable

Q81: If stock sold or exchanged is not

Q88: A partnership sells equipment and recognizes depreciation

Q94: Leigh inherited $65,000 of City of New

Q122: A cash-basis taxpayer can defer income recognition

Q134: Dixie Corporation distributes $31,000 to its sole