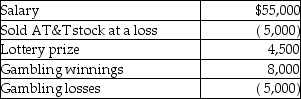

A taxpayer had the following income and losses in the current year:  What is the taxpayer's adjusted gross income (not taxable income) ?

What is the taxpayer's adjusted gross income (not taxable income) ?

Definitions:

Nominal Interest Rates

are the stated interest rates on financial products or loans, not adjusted for inflation, indicating the actual rate of interest charged by lenders.

Real Interest Rates

The interest rate adjusted for inflation, reflecting the real cost of borrowing and the true return on savings.

Tax-exempt Interest Payments

Interest income that is not subject to federal income tax.

Riskier Loans

Loans that have a higher chance of default, often associated with higher interest rates to compensate for the increased risk.

Q13: The Deferred Model investment outperforms the Current

Q15: All of the following are separately stated

Q28: "Working condition fringe benefits," such as memberships

Q42: Flow-through entities include all of the following

Q50: Generally, deductions for (not from)adjusted gross income

Q72: Shane and Alyssa (a married couple)have AGI

Q90: Torrie and Laura form a partnership in

Q91: Buzz is a successful college basketball coach.

Q97: Kathleen received land as a gift from

Q100: During the current year, Paul, a single