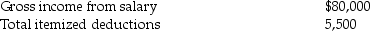

Steve Greene, age 66, is divorced with no dependents. In 2014 Steve had income and expenses as follows:

Compute Steve's taxable income for 2014. Show all calculations.

Compute Steve's taxable income for 2014. Show all calculations.

Definitions:

Complexity

The state or quality of being complex, involving multiple interconnected elements, factors, or variables that make understanding or problem-solving challenging.

Team Leadership Research

The study of how leadership styles, behaviors, and strategies impact the performance and effectiveness of teams.

1990s

A decade known for significant technological advancements, globalization, and cultural shifts that influenced various aspects of society, including leadership and management practices.

1960s

A decade of significant social, political, and cultural change, marked by movements for civil rights, freedom of expression, and innovation in arts and sciences.

Q10: The corporate capital loss carryback and carryover

Q12: Candice owns a mutual fund that reinvests

Q63: Analyze the information; make analogies and reach

Q65: In a limited partnership, the limited partners

Q67: Joy purchased 200 shares of HiLo Mutual

Q73: The Roth IRA is an example of

Q78: A Technical Advice Memorandum is usually<br>A)an internal

Q91: All of the following could file partnership

Q98: Norah's Music Lessons Inc. is a calendar

Q116: Joycelyn gave a diamond necklace to her