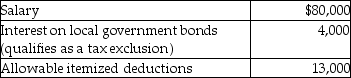

A single taxpayer provided the following information for 2014:  What is taxable income?

What is taxable income?

Definitions:

White Fathers

White Fathers, without further context, seems like a term that could refer to racial demographic aspects of fatherhood, focusing on fathers identified as belonging to the white racial group. However, without specific context or usage, the term's meaning may vary.

Early Adulthood

Early adulthood is a developmental stage ranging approximately from the ages of 20 to 40, marked by the pursuit of independence, career development, and for many, the establishment of a family.

Parenting Usually Ends

While the active role of raising and guiding a child may diminish as the child reaches adulthood, the relationship and a form of parenting often continue throughout life.

Spoil a Child

Overindulging or providing excessive leniency to a child, potentially leading to behavioral issues or a lack of responsibility.

Q31: Brianna purchases stock for $8,000. The stock

Q57: Willa is considering receiving either $20,000 of

Q60: Adjusted net capital gain is taxed at

Q75: Atiqa receives a nonliquidating distribution of land

Q85: What factors are considered in determining whether

Q88: For federal income tax purposes, income is

Q89: If a taxpayer's method of accounting does

Q106: Which of the following dependent relatives does

Q119: Chen had the following capital asset transactions

Q127: The AAA Partnership makes an election to