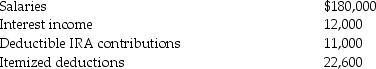

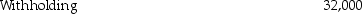

The following information is available for Bob and Brenda Horton, a married couple filing a joint return, for 2014. Both Bob and Brenda are age 32 and have no dependents.

a. What is the amount of their gross income?

a. What is the amount of their gross income?

b. What is the amount of their adjusted gross income?

c. What is the amount of their taxable income?

d. What is the amount of their tax liability (gross tax)?

e. What is the amount of their tax due or (refund due)?

Definitions:

Family Dynamics

The patterns of relating, or interactions between family members, each with their roles and relationships.

Development

The process of growth or progress in any dimension, such as physical, emotional, intellectual, or social.

Personality Disorders

Mental health conditions characterized by enduring patterns of behavior, cognition, and inner experience that deviate from the expectations of the individual's culture.

Narcissistic Personality Disorder

A mental disorder characterized by a long-term pattern of exaggerated self-importance, need for admiration, and a lack of empathy for others.

Q13: The Deferred Model investment outperforms the Current

Q55: Depreciation recapture does not apply to a

Q56: The Deferred Model has all of the

Q64: An uncle gifts a parcel of land

Q65: Given a choice between a fully-taxable investment

Q68: Chen contributes a building worth $160,000 (adjusted

Q71: A qualifying child of the taxpayer must

Q84: S status can be elected if 50%

Q108: A taxpayer sells an asset with a

Q126: Because of the locked-in effect, high capital