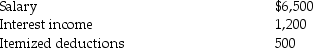

The following information for 2014 relates to Emma Grace, a single taxpayer, age 18:

a. Compute Emma Grace's taxable income assuming she is self-supporting.

a. Compute Emma Grace's taxable income assuming she is self-supporting.

b. Compute Emma Grace's taxable income assuming she is a dependent of her parents.

Definitions:

Health Psychologist

A professional who specializes in understanding how psychological, behavioral, and cultural factors contribute to physical health and illness.

Preventing Illness

The practice of engaging in behaviors and interventions that aim to reduce the risk of disease development, including vaccinations, healthy lifestyle choices, and environmental changes.

Hospital

A medical facility where patients receive care from specialized medical and nursing personnel, equipped with specialized healthcare apparatus.

Health Psychologists

Experts focused on examining the ways in which biological, psychological, and social elements influence both health and sickness.

Q14: Identify which of the following statements is

Q14: Unused charitable contributions of a corporation are

Q19: Bartlett Corporation, a U.S. manufacturer, reports the

Q29: Which of the following is not considered

Q54: All of the following statements are true

Q72: A corporation has the following capital gains

Q82: A corporation is owned equally by 10

Q86: Various members of Congress favor a reduction

Q113: Tina purchases a personal residence for $278,000,

Q124: If a shareholder transfers liabilities to a