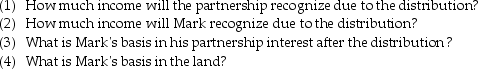

Mark receives a nonliquidating distribution of $10,000 cash and a parcel of land having an adjusted basis of $18,000 and a fair market value of $25,000.

a. Mark's basis in his partnership interest prior to the distribution is $50,000.

b. Assume Mark's basis in his partnership interest is instead $22,000 and redetermine the responses to questions (1)through (4).

b. Assume Mark's basis in his partnership interest is instead $22,000 and redetermine the responses to questions (1)through (4).

Definitions:

Mixed Branding

A strategy where a company markets products under various brand names, each with a distinct image and demographic appeal.

Product Line Extensions

Introducing additional items in the same product category under the same brand name, often to target a new segment.

MultiBranding

A marketing strategy where a company markets multiple brands in the same product category or sector.

Brand Licensing

The authorization by the licensor to allow a licensee to use a brand's name, logo, or product for a specified period against a fee.

Q10: The corporate capital loss carryback and carryover

Q18: Gross income is income from whatever source

Q36: What are some of the consequences of

Q41: Self-employment taxes include components for<br>A)Medicare hospital insurance

Q88: Describe the appeals process in tax litigation.

Q95: When computing a corporation's alternative minimum taxable

Q105: In computing AMTI, adjustments are<br>A)limited.<br>B)added only.<br>C)subtracted only.<br>D)either

Q115: Individuals Opal and Ben form OB Corporation.

Q115: Juanita's mother lives with her. Juanita purchased

Q134: Dixie Corporation distributes $31,000 to its sole