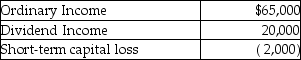

Bryan Corporation, an S corporation since its organization, is owned entirely by Mr. Bryan. The corporation uses a calendar year as its taxable year. Mr. Bryan paid $120,000 for his Bryan stock when the corporation was formed on January 1 of this year. For this year, Bryan Corporation reported the following results:  Distributions of $40,000 were made during the year. What is the basis of Mr. Bryan's stock on December 31?

Distributions of $40,000 were made during the year. What is the basis of Mr. Bryan's stock on December 31?

Definitions:

Competitive Advantage

The edge that gives organizations a more beneficial position than their competitors and allows them to generate more profits and retain more customers.

Inimitability

The quality of being impossible to copy or imitate, often contributing to a competitive advantage.

Organizational Behavior

studies how individuals and groups interact within a company and how these interactions affect the organization's functioning.

MacroEconomics

The branch of economics that studies the behavior and performance of an economy as a whole, focusing on broad phenomena like inflation, national income, and unemployment.

Q5: Ken invests $10,000 in a deductible IRA

Q14: Any gain or loss resulting from the

Q20: John contributes land having $110,000 FMV and

Q30: Section 1250 could convert a portion of

Q37: Which of the following is not a

Q45: Chad and Jaqueline are married and have

Q50: One requirement of a personal holding company

Q61: Which of the following characteristics belong(s)to the

Q101: The alternative minimum tax applies to individuals,

Q115: Marisa has a 75% interest in the