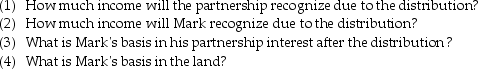

Mark receives a nonliquidating distribution of $10,000 cash and a parcel of land having an adjusted basis of $18,000 and a fair market value of $25,000.

a. Mark's basis in his partnership interest prior to the distribution is $50,000.

b. Assume Mark's basis in his partnership interest is instead $22,000 and redetermine the responses to questions (1)through (4).

b. Assume Mark's basis in his partnership interest is instead $22,000 and redetermine the responses to questions (1)through (4).

Definitions:

Speeches

Speeches are formal addresses or discourses delivered to an audience for a variety of purposes, such as to inform, persuade, entertain, or inspire.

Schramm's Model

Schramm's Model is a theory in communication that emphasizes the importance of feedback in the encoding and decoding processes between the sender and receiver.

Dateline

A line at the beginning of a news article that gives the date and place of origin of the news report.

Concisely

Concisely refers to expressing something in a clear and brief manner, without using unnecessary words or details.

Q48: The health insurance premium assistance credit is

Q52: If a taxpayer's AGI is greater than

Q60: If no gain is recognized in a

Q61: Which of the following characteristics belong(s)to the

Q82: In 1980, Mr. Lyle purchased a factory

Q83: Which of the following statements is false?<br>A)Under

Q86: What is the purpose of Sec. 1245

Q88: A partnership sells equipment and recognizes depreciation

Q108: Jake and Christina are married and file

Q114: John has $55,000 net earnings from a