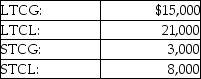

A corporation has the following capital gains and losses during the current year:  The tax result to the corporation is

The tax result to the corporation is

Definitions:

Departmental Overhead Rate

The rate at which indirect production costs are allocated to specific departments within a manufacturing process.

Plantwide Overhead Rate

A single overhead absorption rate used throughout an entire manufacturing plant.

Overhead Allocations

The process of assigning indirect costs to different cost objects such as products, services, or departments.

Activity-based Costing

A costing methodology that assigns indirect costs to products or services based on the activities that drive those costs, aimed at providing more accurate product costing.

Q14: Generally, in the case of a divorced

Q16: Tony supports the following individuals during the

Q22: Carter dies on January 1, 2013. A

Q35: Indicate for each of the following the

Q40: Hong earns $127,300 in her job as

Q41: The Tax Court departs from its general

Q51: Marguerite and Josephus have two children, ages

Q70: Employer-sponsored qualified retirement plans and deductible IRAs

Q87: Harley's tentative minimum tax is computed by

Q103: The exchange of a partnership interest for