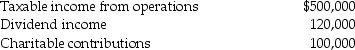

Concepts Corporation reported the following results for the current year:

Taxable income from operations does not include the dividend income or the contributions. The dividend income is from minor investments in U.S. publicly-traded stocks. Calculate Concept Corporation's taxable income and any carryovers that may be generated.

Taxable income from operations does not include the dividend income or the contributions. The dividend income is from minor investments in U.S. publicly-traded stocks. Calculate Concept Corporation's taxable income and any carryovers that may be generated.

Definitions:

Human Interaction

The communication and exchange of information or ideas between humans, often facilitated by technology in contemporary contexts.

Virus And Worm

Malicious software programs, where a virus attaches itself to clean files and spreads through infected files, while a worm is a standalone software that replicates without needing to attach to host files.

Stealth Virus

A virus that temporarily erases its code from the files where it resides and hides in the active memory of the computer.

Antivirus Software

A program designed to detect, prevent, and remove malware, including viruses, worms, and Trojan horses, to protect computers and networks.

Q40: When a taxpayer contacts a tax advisor

Q46: At the beginning of this year, Thomas

Q46: If a fully-taxable bond yields a BTROR

Q51: Why should tax researchers take note of

Q56: Blaine Greer lives alone. His support comes

Q68: Chen contributes a building worth $160,000 (adjusted

Q76: For livestock to be considered Section 1231

Q77: Voluntary revocation of an S corporation election

Q94: For purposes of the dependency exemption, a

Q97: Janice transfers land and a building with