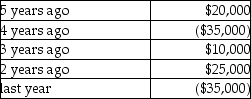

For this tax year, Madison Corporation had taxable income of $80,000 before using any of the net operating loss from the previous year. Madison has never elected to forgo the carryback of its losses since incorporation five years ago. Madison's books and records reflect the following income (loss) since its incorporation.  What amount of taxable income (loss) should Madison report on its current tax return?

What amount of taxable income (loss) should Madison report on its current tax return?

Definitions:

Bonds

Long-term debt securities issued by corporations, governments, or other entities to finance operations or projects, which obligate the issuer to pay interest to bondholders.

Accrued Interest

The interest that has accumulated on a bond or loan since the last interest payment was made but has not yet been paid to the lender.

Long-Term Investment

Assets purchased by a company that are intended to be held for more than one year for the purpose of earning returns on the investment over time.

Q3: The facts must be determined. However, some

Q4: Lily had the following income and losses

Q45: Determine which authorities are applicable.

Q55: Depreciation recapture does not apply to a

Q56: Blaine Greer lives alone. His support comes

Q77: Melanie is in the 39.6% tax bracket

Q98: If real property used in a trade

Q98: Norah's Music Lessons Inc. is a calendar

Q107: A liquidating corporation<br>A)recognizes gains and losses on

Q124: In the syndication of a partnership, brokerage