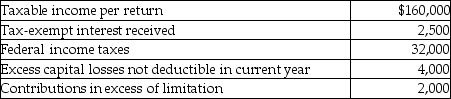

Greg Corporation, an accrual method taxpayer, had accumulated earnings and profits of $300,000 as of December 31, last year. For its current tax year, Greg's books and records reflect the following:  Based on the above, what is the amount of Greg Corporation's current earnings and profits for this year?

Based on the above, what is the amount of Greg Corporation's current earnings and profits for this year?

Definitions:

Accounts Receivable

Money owed to a business by its clients or customers for goods or services delivered but not yet paid for.

Cash Equivalents

Short-term, highly liquid investments that are readily convertible to known amounts of cash and which are subject to an insignificant risk of changes in value.

Bank Notes

Paper money issued by a central bank, constituting a common form of legal tender in many economies around the world.

Operating Activities

Activities that constitute the primary or main activities of a company, including production, sales, and delivery of goods and services.

Q1: Final regulations can take effect on any

Q8: Star Corporation makes a liquidating distribution of

Q45: A married couple in the top tax

Q58: If a gain is realized on the

Q60: If no gain is recognized in a

Q69: Elise contributes $1,000 to a deductible IRA.

Q69: Depreciable property used in a trade or

Q109: All tax-exempt bond interest income is classified

Q119: On July 1, Alexandra contributes business equipment

Q136: A building used in a business is