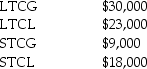

Small Corporation had the following capital gains and losses during the current year:

Taxable income, exclusive of the capital gains and losses above, is $68,000.

Taxable income, exclusive of the capital gains and losses above, is $68,000.

a. How should the capital gains and losses be treated for the current year?

b. What is the taxable income for the current year taking into consideration the capital gains and losses?

Definitions:

Probability

Probability is a measure of the likelihood that an event will occur, expressed as a number between 0 and 1, where 0 indicates impossibility and 1 indicates certainty.

Student T Random Variable

A variable that follows the Student's t-distribution, often used in the context of small sample sizes when the population variance is unknown.

Variance

The average of the squared differences from the mean, showing the spread between numbers in a data set.

Degrees of Freedom

The number of independent values or quantities which can be assigned to a statistical distribution, typically in the context of parameter estimation or hypothesis testing.

Q4: Under what circumstances might a tax advisor

Q10: The sale of inventory results in ordinary

Q14: Generally, in the case of a divorced

Q43: How does the treatment of a liquidation

Q44: Jesse installed solar panels in front of

Q53: A partnership's liabilities have increased by year-end.

Q62: In the Exempt Model, the earnings are

Q64: Does Title 26 contain statutory provisions dealing

Q118: Ariel receives from her partnership a nonliquidating

Q118: Major Corporation's taxable income for the current