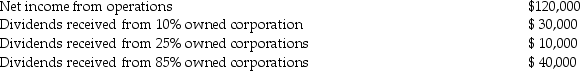

Crowley Corporation has the following income during the current year:

What is the amount of the corporation's taxable income?

What is the amount of the corporation's taxable income?

Definitions:

Comfortable

A state of physical ease and freedom from pain or constraint, as well as providing a sense of psychological ease and contentment.

Age In Place

To remain in the same home and community in later life, adjusting but not leaving when health fades.

Pool Resources

The act of combining assets, funds, or talents of a group of people for a common purpose or benefit.

Compulsive Hoarding

The urge to accumulate and hold on to familiar objects and possessions, sometimes to the point of their becoming health and/or safety hazards. This impulse tends to increase with age.

Q19: Landry exchanged land with an adjusted basis

Q23: Jamahl has a 65% interest in a

Q33: Luke's offshore drilling rig with a $700,000

Q35: All of the following are requirements to

Q53: The difference between the BTRORs of fully-taxable

Q65: Stephanie's building, which was used in her

Q82: Minna is a 50% owner of a

Q92: The holding period of like-kind property received

Q98: Sec. 1231 property must satisfy a holding

Q108: Steve and Jennifer are in the 33%