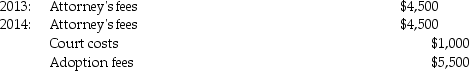

Tyler and Molly, who are married filing jointly with $210,000 of AGI in 2014, incurred the following expenses in their efforts to adopt a child:

The adoption was finalized in 2014. What is the amount of the allowable adoption credit in 2014?

The adoption was finalized in 2014. What is the amount of the allowable adoption credit in 2014?

Definitions:

Absolute Threshold

The minimum intensity of stimulation that must occur before you experience a sensation.

Exposed Stimuli

Stimuli that are presented to an individual in a way that they can be perceived and processed by the senses.

Sense of Smell

The ability to perceive odors or scents through the olfactory system, which is part of the sensory system.

Semicircular Canals

Sense organs in the inner ear that contribute to equilibrium by responding to rotation of the head.

Q27: Danielle transfers land with a $100,000 FMV

Q38: In the current year, Bosc Corporation has

Q43: What is "forum-shopping"?

Q50: Jack purchases land which he plans on

Q67: This year, a contractor agrees to build

Q74: The marginal tax rate is useful in

Q74: A taxpayer purchased a factory building in

Q85: Which of the following steps, related to

Q91: Identify which of the following statements is

Q113: Additional capital may be obtained by a