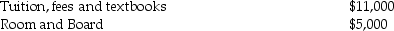

Tom and Anita are married, file a joint return with an AGI of $165,000, and have one dependent child, Tim, who is a first-time freshman in college. The following expenses are incurred and paid in 2014:

What is the maximum education credit allowed to Tom and Anita?

What is the maximum education credit allowed to Tom and Anita?

Definitions:

Andropause

A term sometimes used to describe aging-related hormone changes in men, similar to menopause in women.

Reduced Sperm Count

A medical condition characterized by a lower than normal concentration of sperm in a man's ejaculate, potentially leading to fertility issues.

Hormone Production

The biological process by which hormones are synthesized and secreted in the body, regulating various bodily functions.

Growth Spurts

Rapid periods of physical growth and development that occur during childhood and adolescence.

Q19: Bartlett Corporation, a U.S. manufacturer, reports the

Q21: To claim the Lifetime Learning Credit, a

Q25: Under the cash method of accounting, income

Q34: In which courts may litigation dealing with

Q47: Joe has $130,000 net earnings from a

Q86: What is the purpose of Sec. 1245

Q97: Janice transfers land and a building with

Q97: Lara started a self-employed consulting business in

Q103: The exchange of a partnership interest for

Q114: John has $55,000 net earnings from a