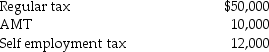

Beth and Jay project the following taxes for the current year:

How much in estimated tax payments (including withholding from wages and quarterly estimated payments)should the taxpayers pay this year in order to avoid underpayment penalties under the following assumptions regarding the preceding tax year?

How much in estimated tax payments (including withholding from wages and quarterly estimated payments)should the taxpayers pay this year in order to avoid underpayment penalties under the following assumptions regarding the preceding tax year?

a. Preceding tax year-AGI of $140,000 and total taxes of $36,000.

b. Preceding tax year-AGI of $155,000 and total taxes of $50,000.

Definitions:

Cash Management

The process of collecting, managing, and investing a company's cash in a way that maximizes the efficiency of its operations and reduces the risk of financial distress.

Corporate Treasurer

An executive responsible for managing an organization's investments, capital structure, and financial strategies.

Credit Management

The practice of granting credit, recovering this credit when it's due, and ensuring compliance with company credit policy.

Financial Management

The practice of managing an organization's financial activities and resources, aiming to achieve its goals and maximize wealth or value.

Q2: Clark and Lois formed an equal partnership

Q26: Adam Smith's canons of taxation are equity,

Q26: Under the accrual method of accounting, the

Q67: A corporation's E&P is equal to its

Q69: The general business credit includes all of

Q76: If a partner contributes property to a

Q77: In a parent-subsidiary controlled group, the common

Q87: Mitchell and Debbie, both 55 years old

Q108: Summer Corporation has the following capital gains

Q115: Individuals Opal and Ben form OB Corporation.