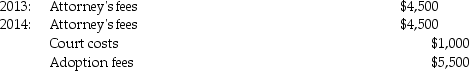

Tyler and Molly, who are married filing jointly with $210,000 of AGI in 2014, incurred the following expenses in their efforts to adopt a child:

The adoption was finalized in 2014. What is the amount of the allowable adoption credit in 2014?

The adoption was finalized in 2014. What is the amount of the allowable adoption credit in 2014?

Definitions:

Postamputation

The period or condition following the surgical removal of a limb or other body part, focusing on recovery and rehabilitation.

Chronic Pain

Persistent pain that lasts for months or longer, often without a clear cause, significantly affecting an individual's quality of life.

Hypertension

A chronic medical condition characterized by elevated blood pressure in the arteries, leading to increased risk of heart disease, stroke, and other conditions.

Irritable Bowel Syndrome

A prevalent condition that impacts the large intestine, leading to signs such as abdominal cramps, pain, swelling, flatulence, and either diarrhoea or constipation.

Q3: Passive activity loss limitations apply to S

Q20: Identify which of the following statements is

Q39: Jeffery and Cassie, who are married with

Q46: Frank, a single person age 52, sold

Q48: A corporation distributes land worth $200,000 to

Q55: Read the cases and rulings referenced in

Q97: If each party in a like-kind exchange

Q103: The exchange of a partnership interest for

Q108: Summer Corporation has the following capital gains

Q118: A tax bill introduced in the House